In September 2021, Foundation for India and Indian Diaspora Studies USA ( http://FIIDS-USA.ORG ) conducted a survey to determine which issues and governmental policies are most relevant to Indo-Americans and Non-Resident Indians (NRIs). The survey covered various topics ranging from immigration issues, investment, dual citizenship, double taxation and transfer of social security funds.

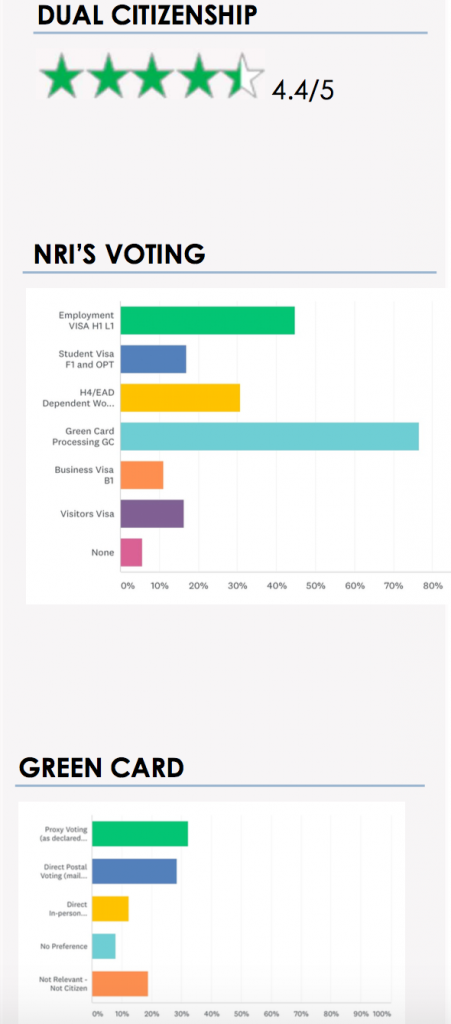

Among the surveyed questions, a demand for dual citizenship received a maximum support with 4.4 (out of 5) star rating. While citizens of many other countries have had the ability to apply for US citizenship without renouncing the citizenship of their home country, non-resident Indians have been requesting this same opportunity from the Indian government for many years without luck. On January 8, 2002, Dr. L. M. Singhvi, who was the Chairman of the High Level Committee on the Indian Diaspora, had submitted recommendations for dual citizenship. The late Prime Minister Atal Bihari Vajapee had accepted the recommendation in January 2003, however, the 2005 amendment in Citizenship Act of 1955 gave Overseas Citizenship which is short of a dual citizenship. When it came to NRI’s voting, 33% preferred the proxy voting as declared by the government while 28% preferred a direct postal voting.

A need of India’s influence on US immigration policies was the second most important demand NRIs voted on. Among various immigration issues, expediting green card processing received 80% of preference while 60% preference was on H1/L1 related policies and 30% on H4/EAD. In their comments, NRI’s expressed that Indian citizens applying for US Permanent residency face years of painful delays in the processing time by US Immigration Agency due to “country wise quota policy”. They hope that the Indian government brings a spotlight to this subject during the discussion with the US government.

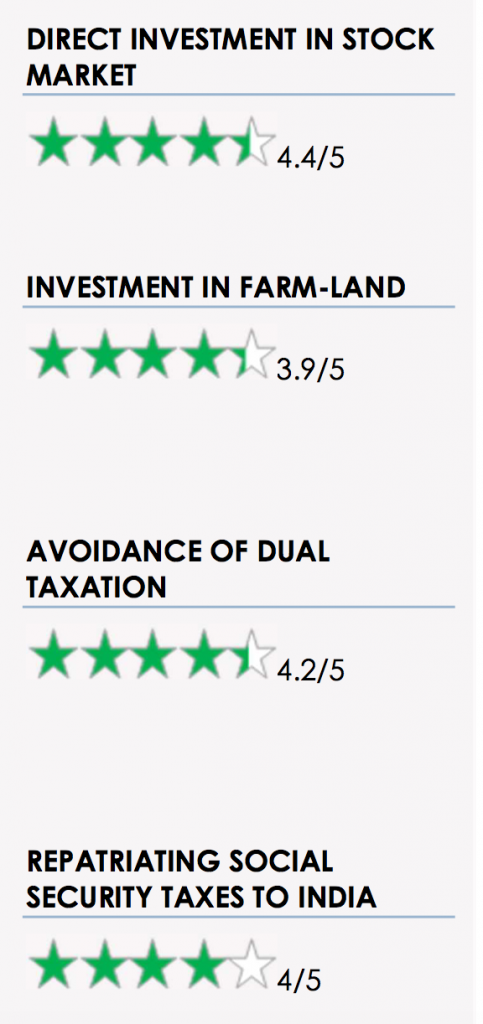

The survey also revealed that various financial, investment and taxation related policies are very important to the NRIs. Among the financial policies, the highest rating 4.4 stars (out of 5) was for permission to directly invest in India’s stock market while allowing investment in farm-land received 3.9 stars (out of 5) rating. On taxation issues, an avoidance of dual taxation received 4.2 star rating and repatriating social security taxes to India received 4.0 star rating. For the repatriation of social security taxes withheld in USA, India would need to have a social security repatriation treaty with US. Similarly, a Double Tax Avoidance Agreement (DTAA) between India and the USA will be needed to avoid a tax evasion route often adopted for investment to India via tax haven countries like Mauritius and Singapore. All these investment and taxation policy changes would increase inflow of foreign funds to India and strengthen the bond of the NRI’s to India.

Foundation for India and Indian Diaspora Studies USA ( FIIDS) is a forum for Policy Studies, Analysis, Advocacy and Awareness related to India and Indian Diaspora. FIIDS has centers in Washington DC, Silicon Valley, New York-New Jersey, Phoenix and Atlanta. For more information visit http://fiids-usa.org or contact info@fiids-usa.org